You won’t get exclusive travel perks like airport lounge access without paying an annual fee, but these 3 credit cards are redefining the value of exceptional redemption rewards with no annual fee.

Bank of America Cash Rewards

The Bank of America Cash Rewards allows you to choose your 3% cash back category including Travel, and Online Shopping (including mobile purchases) which you can use to make travel purchases. Preferred Rewards members earn an additional 25%-75% cash back on every purchase; that means up to 5.25% cash back. Beware, this card charges foreign transaction fees and therefore, not meant for traveling abroad. The Bank of America Travel Rewards is their no-annual fee and no foreign transaction fee credit card meant for traveling abroad. The Bank of America Cash Rewards credit card comes with a $200 cash rewards bonus offer; the Bank of America Travel Rewards credit card comes with a 25,000 bonus points offer ($250 value).

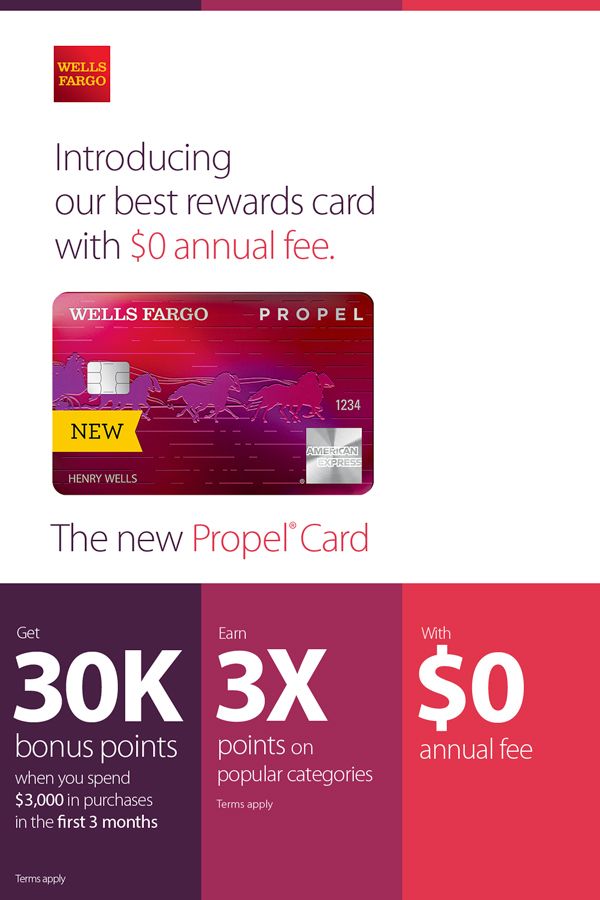

Wells Fargo Propel American Express Card

Wells Fargo Propel American Express Card earns 3x points on travel (flights, hotels, car rentals), dining (“eating out and ordering in”), transit (gas stations, rideshares, public transit), and popular streaming services; 1x points on all other purchases. When combined with the Wells Fargo Visa Signature Card (also no-annual fee), your points are worth 50% more when redeemed for airfare on its portal; that’s 4.5x points (effectively 4.5% cash back) per bonus category similar to the Chase Sapphire Reserve redemption benefit without the $550 annual fee. With up to 30,000 bonus points offer, no foreign transaction fees, cell phone protection, and backed by American Express’ leading customer service, the Wells Fargo Propel American Express Card packs a lot of perks at an unbeatable price. The only drawback to this card is that American Express isn’t as widely accepted as Visa and Mastercard, worldwide.

Capital One VentureOne

The VentureOne Rewards from Capital One earns unlimited 1.25x miles per dollar on all purchases, effectively 1.25% cash back. Better still, is all the perks this card packs: no foreign transaction fees; auto rental collision damage waiver; roadside assistance; travel accident insurance; extended warranty; premium experiences (access to VIP tickets, 5-star meals and beyond); and Visa Signature benefits. Except for American Express, the Capital One VentureOne is the only no-annual-fee credit card that allows transferring reward miles to 15+ travel loyalty programs, a premium feature that commonly comes from a fee-based credit card. But unlike American Express, as a Visa Signature card, the Capital One VentureOne is more widely accepted.